We use cookies to make your experience better. To comply with the new e-Privacy directive, we need to ask for your consent to set the cookies. Learn more.

- 12/12/2022

Throughout history, the art market demonstrated resilience in facing economic and political crises. However, the pandemic created a challenging environment for almost every gallery around the world, with the decreasing footfall of art collectors, and declining revenues. According to many interviews conducted with art gallerists, the pandemic was one of their biggest challenges throughout their career, making many of them rethink their entire business model to keep their business afloat

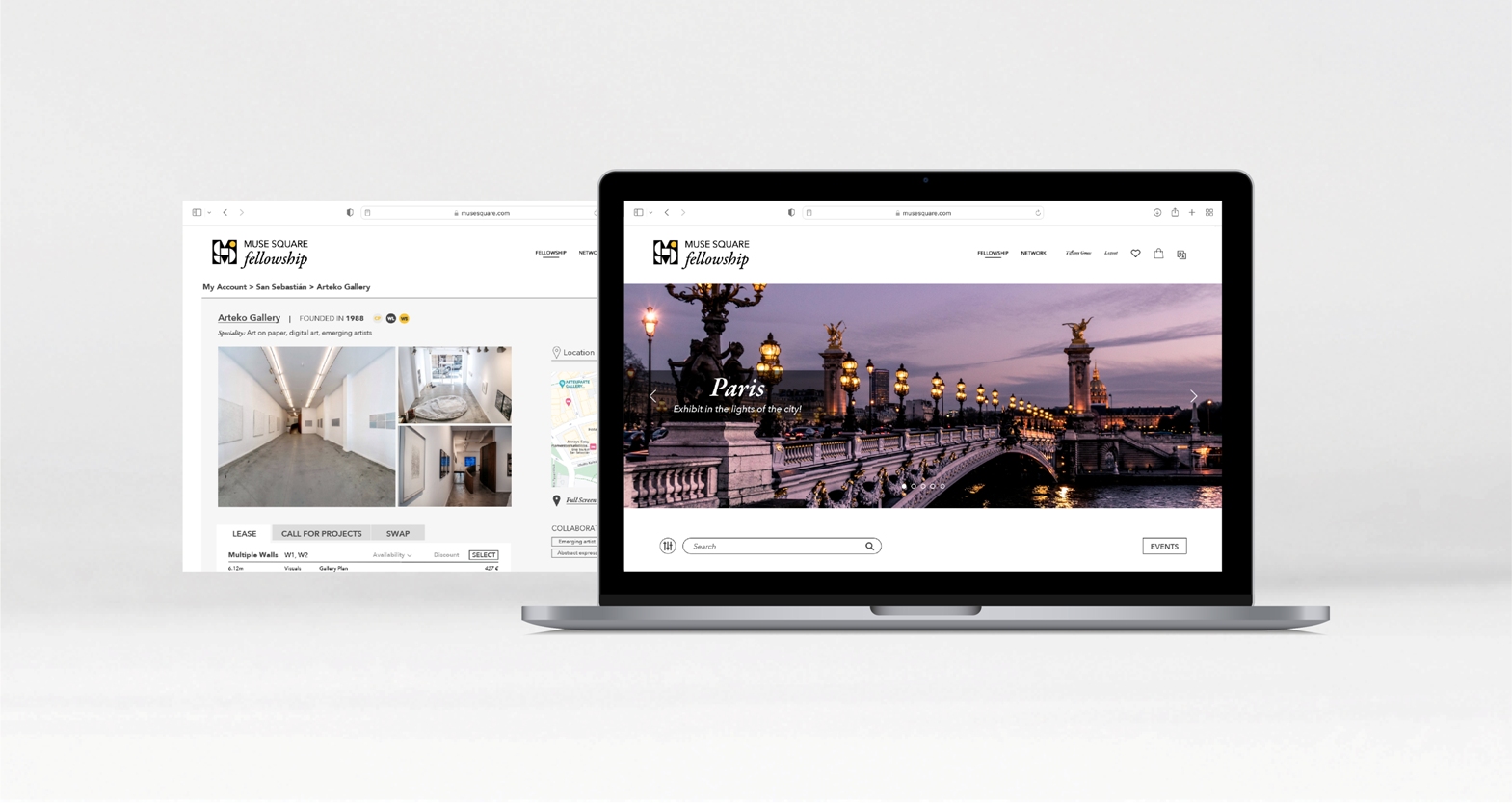

To help the galleries better navigate the uncertainties of any upcoming economic crisis, Muse Square developed its art fellowship solution, a collaborative platform enabling galleries to grow their business with minimal risks.

1. An Ideal Solution for the Galleries Following a Cautious Strategy

Liquidity is a major source of anxiety for gallerists as a lack of cashflow would affect their ability to pay rent, salaries, and other fixed costs. Galleries should ideally have a financial buffer to cope with any emergency that might arise.

While established galleries have a more solid financial standings, emerging galleries tend to struggle to keep aside a financial buffer, hence, they become more cautious with their expenditures. Another example of galleries adopting a cautious strategy is the ones that spend heavily on art fairs without getting their expected return on investment. Those galleries end up limiting their spending to successfully end their fiscal year without going through a cashflow deficit.

While following a cautious strategy is a safe side plan for the galleries wanting to preserve their business, the Muse Square fellowship proposes a wide range of services enabling galleries to grow their business more efficiently.

Using the fellowship platform, galleries can lease their walls to their peers, which allows them to improve their financial standing and at the same time widen the artwork collections presented to their art buyers.

They can also monetize their walls during downtimes. For example, if a gallery has an exhibition from March to May and from September to October, it can rent its walls between the two exhibitions using the fellowship platform.

Galleries can also swap their walls with their peers to access new markets without spending money. In all cases, the galleries have full control over their walls’ configurement, schedule, and gallery choice.

2. A Key Solution for the Galleries Adopting an Expansion Strategy

Some galleries want to operate in different markets to meet new art collectors and increase their opportunities, but without taking risks.

Through the Muse Square fellowship, those galleries can collaborate with their peers overseas to expand to new art destinations without bearing the risks of opening a branch in a new city. They can explore new markets, widen their network, and give more visibility to their artists simply by renting the walls of a gallery or swapping their walls with a peer located in their targeted destination. Additionally, gallerists can work on projects proposed by their peers in their preferred destinations.

Muse Square proposes a revenue-sharing model that enables galleries to exhibit in their peer’s galleries by agreeing on a 50%/50% revenue sharing. This financial model is interesting for galleries wanting to scale up risk-free.

Muse Square’s goal is to always help galleries grow even in downtimes. Through the fellowship platform, galleries can exhibit across Europe with fewer risks.

Learn more about the Muse Square fellowship.

Start Today; it’s free.

We use cookies to make your experience better. To comply with the new e-Privacy directive, we need to ask for your consent to set the cookies. Learn more.